量化练手:基于北向资金的量化策略

量化练手

最近在学习量化,在使用各种量化框架之前,试着不基于其他框架,只基于pandas和 matplotlib,编写一个量化策略,做量化学习的练手,同时也是对不熟悉的python做个练手。

量化策略

参考北向资金的每日净流入情况,决定是否买入沪深300指数。

具体策略如下:

1、获得北向资金每日净流入数,北向资金净流入为 沪港通与深港通净流入数据之和。

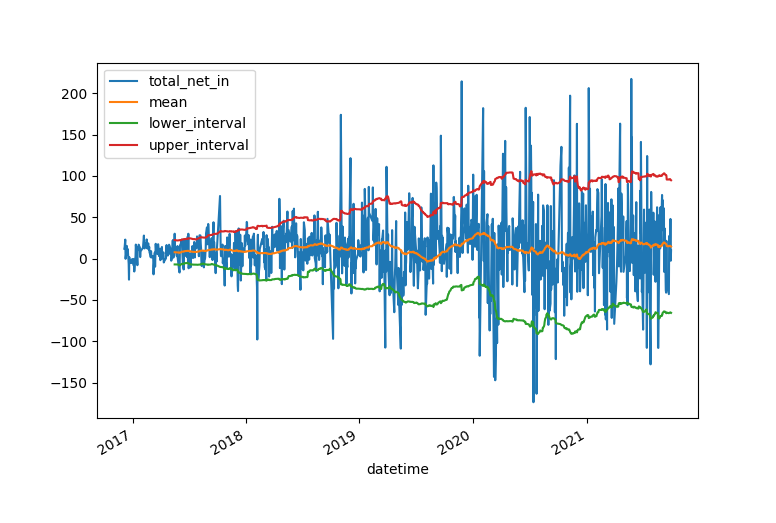

2、生成北向资金每日净流入资金的布林线;(此处采用100天均值,1.5倍标准差)

3、如果当日净流入高于布林线,则认为买入沪深300指数,次日按开盘价买入90%的仓位,如果连续高出,只买入一次;

4、如果当日净流入低于布林线,则认为卖出,次日按开盘价清仓。

5、交易手续费为万分之二;

6、参考一些指数基本的收费规则,如果持有天数低于7天,卖出时手续费会很高,我设置了trade_interval,默认为7天,也就是至少持仓7天,才会卖出。

数据来源

北向资金数据与指数数据来爬取自tt_fund。

beixiang_20211001.csv

market_index_20211001.csv

结果分析

北向资金布林线情况:

策略运行结果, 其中benchMark为沪深指数蓝线,红线为策略的运行结果。

从 2016-12-07开始至2021-10-01,总共执行买操作25次,卖操作25次.

10000的起初资金,最终市值为16436.075215, 近5年 64%的收益,高于沪深300 40%的收益。

详细代码

github地址 https://github.com/quentinxxz/QuantLib/tree/main/beixiang

#!/usr/bin/env python3

# -*- coding: utf-8 -*-

"""

Created on Tue Sep 21 15:14:53 2021

@author: quentinxxz

"""

#!/usr/bin/env python3

# -*- coding: utf-8 -*-

"""

Created on Sun Sep 19 20:42:39 2021

@author: quentinxxz

"""

import pandas as pd

import datetime

import matplotlib.pyplot as plt

# 数据准备处理

def prepareBeixiangData():

#爬下来的北向资金数据

df = pd.read_csv('beixiang_20211001.csv')

df['datetime']= pd.to_datetime(df['datetime'] ,format="%Y-%m-%d")

# 1表示沪股通, 3为深股通, 4为

df_1 = df[df['marketType'] == 1]

df_3 = df[df['marketType'] == 3]

df = pd.merge(df_1,df_3,suffixes=('_1', '_3'),how='left',on='datetime' )

# 合并沪股通与深股通数据

df['total_in']=df['total_in_1']+df['total_in_3']

df['total_out']=df['total_out_1']+df['total_out_3']

df['total_net_in']=df['total_net_in_1']+df['total_net_in_3']

df['grand_total_in']=df['grand_total_in_1']+df['grand_total_in_3']

df['today_balance']=df['today_balance_1']+ df['today_balance_3']

df=df.loc[:,['datetime','total_in','total_out','total_net_in','grand_total_in','today_balance']]

# 按日期排序

df.set_index('datetime',drop=False,append=False,inplace=True)

df.sort_index(ascending=True,inplace=True)

#df.sort_values(by='datetime',ascending=True,inplace= True)

# 计算布林线

df['std'] = df['total_net_in'].rolling(100).std()

df['mean'] = df['total_net_in'].rolling(100).mean()

df['lower_interval'] = df['mean'] - 1.5*df['std']

df['upper_interval'] = df['mean'] + 1.5*df['std']

# 选取一段数据做展示

#s_date = datetime.datetime.strptime('20190401', '%Y%m%d')

#e_date = datetime.datetime.strptime('20200508', '%Y%m%d')

# d_t = df[(df['datetime']<e_date) & (df['datetime']>s_date) ]

# d_t.plot.line(x='datetime',y=['total_net_in','mean','lower_interval','upper_interval'])

return df

# 准备沪深300指数

def prepareShangZheng():

df= pd.read_csv('market_index_20211001.csv')

df['datetime']= pd.to_datetime(df['datetime'])

df.set_index('datetime',drop=False,append=False,inplace=True)

df=df[df['code']==300]

df.sort_index(ascending=True,inplace=True)

return df

# 计算买卖时机,deprecated

def updateBuyAndSell(bx):

bx.loc[bx['lower_interval']>bx['total_net_in'], 'trade']=1

bx.loc[bx['upper_interval']<bx['total_net_in'], 'trade']=-1

# 交易回测

# bx为北向资金数据,

# benchmark为 回测参考 本例中采用上证指烽,

# cost_ration为手续费比例,默认万二,

# init_cap为初始资金,

# delay代表 基于北向资金分析数据,几日后实施交易,至少为1天

def backTrade(bx,benchmark,cost_ration=0.0002,init_cap=10000,delay=1,trade_interval=7):

count=0

trade_records = pd.DataFrame(columns=['operation','trade_val','trade_vol','acc_val_end','acc_vol_end','total_value','capital','order_cost'],index=['datetime'])

for pos in range(len(bx)) :

#取对应的交易日

next_trade_pos = pos+ delay

if next_trade_pos >= len(bx):

break

trade_day = bx.iloc[next_trade_pos]['datetime']

# 如果北向资金净流入,低于布林线,做卖出操作 operation -1代表卖出

if pd.isnull(bx.iloc[pos]['lower_interval'])==False and bx.iloc[pos]['lower_interval']> bx.iloc[pos]['total_net_in']:

record=pd.DataFrame({'operation':-1},index=[trade_day])

count=count+1

# 如果北向资金净流入,高于布林线,做买入操作 operation 1代表买入

elif pd.isnull(bx.iloc[pos]['upper_interval'])==False and bx.iloc[pos]['upper_interval'] < bx.iloc[pos]['total_net_in']:

count=count+1

record=pd.DataFrame({'operation':1},index=[trade_day])

# 其他情况,不做操作

else:

record=pd.DataFrame({'operation':0},index=[trade_day])

trade_records= pd.concat([trade_records, record])

# 删除首行

trade_records.drop(['datetime'],inplace=True)

# 初始时持币

holdCash =True

capital = init_cap

acc_vol_end =0

acc_val_end =0

total_val = capital

sellCount =0

buyCount = 0

delaySell=False

for index ,row in trade_records.iterrows():

if row['operation'] ==1:

delaySell=False

# 持币且operation 为1时,买入

if row['operation'] ==1 and holdCash==True:

#按开盘价买入,收盘价计算价格,每次交易90%本金,

trade_val = capital*0.9 # 交易额

trade_vol = trade_val/benchmark.loc[index,'price_end'] # 交易量

order_cost = trade_val * cost_ration # 交易手续费

capital = capital-trade_val-order_cost #剩余本金

acc_vol_end = acc_vol_end + trade_vol # 收盘账户持仓数量

acc_val_end = acc_vol_end * benchmark.loc[index,'price_end'] # 收盘账户持仓金额

total_val= acc_val_end + capital # 收盘总金额

print( "buy, date:%s, trade_val:%.2f, acc_val_end:%.2f total_val:%.2f"%(index, trade_val,acc_val_end,total_val))

record=pd.DataFrame({'operation':1,

'trade_val':trade_val,

'trade_vol': trade_vol,

'acc_vol_end': acc_vol_end,

'acc_val_end': acc_val_end,

'total_value':total_val,

'capital':capital,

'order_cost':order_cost},

index=[index])

trade_records.update(record)

holdCash =False

buyCount=buyCount+1

buyDay= index #纪录购买时

elif (delaySell or row['operation'] == -1) and holdCash== False:

if index-buyDay< datetime.timedelta(days=trade_interval) :

print('delaySell,buyDay:%s, currentDay:%s'%(buyDay,index))

delaySell =True

acc_val_end = acc_vol_end * benchmark.loc[index,'price_end'] # 按收盘计算

total_val= acc_val_end + capital

record=pd.DataFrame({'operation':0,

'trade_val':0,

'trade_vol': 0,

'acc_vol_end': acc_vol_end ,

'acc_val_end': acc_val_end,

'total_value':total_val,

'capital':capital,

'order_cost':0},

index=[index])

trade_records.update(record)

else :

#按收盘价卖出,收盘价计算金额,卖出则卖空

trade_val = acc_vol_end *benchmark.loc[index,'price_end'] # 按开盘价卖出全部

trade_vol = acc_val_end

order_cost = trade_val * cost_ration

capital =capital+trade_val-order_cost

acc_vol_end = acc_val_end- trade_vol

acc_val_end = acc_vol_end * benchmark.loc[index,'price_end'] # 按收盘计算

total_val= acc_val_end + capital

record=pd.DataFrame({'operation':-1,

'trade_val':trade_val,

'trade_vol': trade_vol,

'acc_vol_end': acc_vol_end,

'acc_val_end': acc_val_end,

'total_value':total_val,

'capital':capital,

'order_cost':order_cost},

index=[index])

print( "sell, date:%s, trade_val:%.2f, acc_val_end:%.2f total_val:%.2f"%(index, trade_val,acc_val_end,total_val))

trade_records.update(record)

holdCash= True

sellCount=sellCount+1

else :

acc_val_end = acc_vol_end * benchmark.loc[index,'price_end'] # 按收盘计算

total_val= acc_val_end + capital

record=pd.DataFrame({'operation':0,

'trade_val':0,

'trade_vol': 0,

'acc_vol_end': acc_vol_end ,

'acc_val_end': acc_val_end,

'total_value':total_val,

'capital':capital,

'order_cost':0},

index=[index])

trade_records.update(record)

#print("common_day, date:%s,acc_val_end:%.2f,total_val: %.2f "%(index,acc_val_end,total_val))

print("sellCount:%d,buy_count:%d "%(sellCount,buyCount))

return trade_records

# 获取北向数据

bx= prepareBeixiangData()

# 绘制布林线

#bx.plot(x='datetime',y=['total_net_in','lower_interval','upper_interval','mean'] )

# 获取上证指数为参考

bm= prepareShangZheng()

# 进行回测

records= backTrade(bx,bm,delay=0)

#开始比较时间

s_date = datetime.datetime.strptime('20161206', '%Y%m%d')

bm_selected =bm[bm['datetime']>s_date]

# 将参考指数归一化,初始为10000

norm_bm_price = bm_selected['price_end']/ bm_selected.iloc[0]['price_end']*10000

# 将操作纪录归一化,初始为10000

records_select = records[records.index>s_date]

norm_records_total_val = records_select['total_value']/ records_select.iloc[0]['total_value']*10000

norm_bm_price.plot.line(subplots= True,x='datetime',y='price_end',style='b',label='benchMark')

norm_records_total_val.plot.line(subplots=True,style='r',label='beixiang')

plt.grid(True)

plt.show()参考资料

《年化46%的北向资金+20日涨幅的创业板策略》https://www.joinquant.com/view/community/detail/a5fb2c8b9644ea49441cfcfffb735f13

20210101首发于3dobe.com

本站链接:http://3dobe.com/archives/263/